Parents Are Paying Consultants $750,000 to Get Kids Into Ivy League Schools

Acceptance rates at the nation’s top universities are plunging, and parents are doing whatever it takes to get their kids in.

By Francesca Maglione and Paulina Cachero | March 31, 2023, 10:30 AM EDT

The mantra for making it into America’s top schools rings from New York City to Kentucky: Whatever it takes.

College consultants charging as much as $750,000 to build standout applications starting in seventh grade? Worth it, says Hope Choi, whose son applied to 22 schools and has already won a spot at Yale.

Ivy League prices approaching $90,000? “What’s a couple thousand more dollars in debt?” asks 18-year-old Addison Witucki, who set her hopes on going to Harvard or Brown — and then medical school.

Despite public outcry about America’s student loan crisis and soaring college costs, the appeal of an elite education has only gotten stronger. Acceptance rates have plunged below 5%, meaning securing a spot at the top institutions feels akin to winning the lottery.

It’s leaving parents and students wanting a prestigious-if-expensive degree now more than ever, and hunting for the best ways to boost their chances.

Does Prestige Pay?

Miniscule acceptance rates at some of the top colleges illustrate the necessity of finding an edge. Out of the more than 59,000 students who applied to the University of Pennsylvania, 2,400 were accepted. Yale University’s acceptance rate this year was 4.35%, with the application pool being the largest in the college’s history after growing by nearly 50% since 2020.

Acceptance Rates for the Class of 2027

Top colleges are getting more selective as application pools grow

| University | Acceptance Rate |

|---|---|

| Harvard University | 3.40% |

| Columbia University | 3.90% |

| ”University | |

| Yale University | 4.40% |

| Brown University | 5.10% |

| Dartmouth College | 6% |

Source: Harvard, Columbia, University of Pennsylvania, Yale, Brown, Dartmouth

*The University of Pennsylvania does not release exact application numbers

The sense of exclusivity only makes students and parents want it more — the Varsity Blues scandal demonstrated the extreme lengths some wealthy families will go to get their kids into the best schools.

Eric Sherman, a counselor at college counseling firm IvyWise, compares the veneration of name-brand colleges to a Hermes bag.

“You hit a certain point where quality is legitimately increased, and then everything above that is just brand,” said Sherman, who’s also director of college counseling at Kehillah Jewish High School in Palo Alto, California. “I think that there is a really powerful element here where parents, if they’re at a cocktail party they might want to say, ‘Oh, I drive a Maserati and my daughter goes to Penn.’”

There’s also the return on investment to consider for those willing to cover an elite college’s exorbitant costs. According to Georgetown University’s Center on Education and the Workforce, four-year private schools offer the highest ROI based on the average debt taken on and median salaries 10 and 40 years after enrollment.

ROIs for Top Universities

Private, non-profit schools tend to have a higher return on investment

| Institution | Type | Median 10-year earnings | Median debt | 10-year net positive value |

|---|---|---|---|---|

| Massachusetts Institute of Technology | Private nonprofit | $111,222 | $12,000 | $406,000 |

| California Institute of Technology | Private nonprofit | $112,166 | $9,867 | $388,000 |

| Stanford University | Private nonprofit | $97,798 | $11,000 | $333,000 |

| Harvard University | Private nonprofit | $84,918 | $12,072 | $268,000 |

| Georgetown University | Private nonprofit | $96,375 | $14,493 | $245,000 |

| University of Michigan-Ann Arbor | Public | $75,842 | $16,633 | $215,000 |

| University of Virginia-Main Campus | Public | $77,048 | $15,711 | $205,000 |

| Yale University | Private nonprofit | $88,655 | $12,000 | $196,000 |

| University of California-Berkeley | Public | $80,364 | $12,390 | $184,000 |

| University of California-Los Angeles | Public | $73,744 | $14,035 | $101,000 |

Source: Georgetown Center on Workforce and Education

Note: Net present value based on average annual costs, salary after attending and average wage index

“Tuition and cost of attendance is not just going up at Ivy League and competitive schools, it’s going up everywhere,” said Christopher Rim, the CEO of college consulting firm Command Education. “If a Rolls-Royce and a Toyota are the exact same price, which one would you want?”

For the Choi family, the answer is a Rolls-Royce — Choi’s son has already been accepted into Yale, Columbia and the University of Chicago, and is still waiting to hear from his dream school, Stanford. Like many families living in New York City’s Upper East Side, the Chois have paid hundreds of thousands already to put him through private school since kindergarten.

“We are fortunate that price is no object,” said Hope Choi. “Prestige carries a lot of weight and we want him to attend the best college for his future.”

To supplement his schooling, they’ve been working with Command Education since he was in ninth grade, considering it a worthwhile investment in his future. The consulting firm charges as much as $750,000 to work with students starting in seventh grade and as much as $500,000 starting in ninth grade. Altogether, Rim estimates many of his clients spend “over $1 million” to prepare their kids for college.

“No client is paying us these fees to get into a random school,” Rim said.

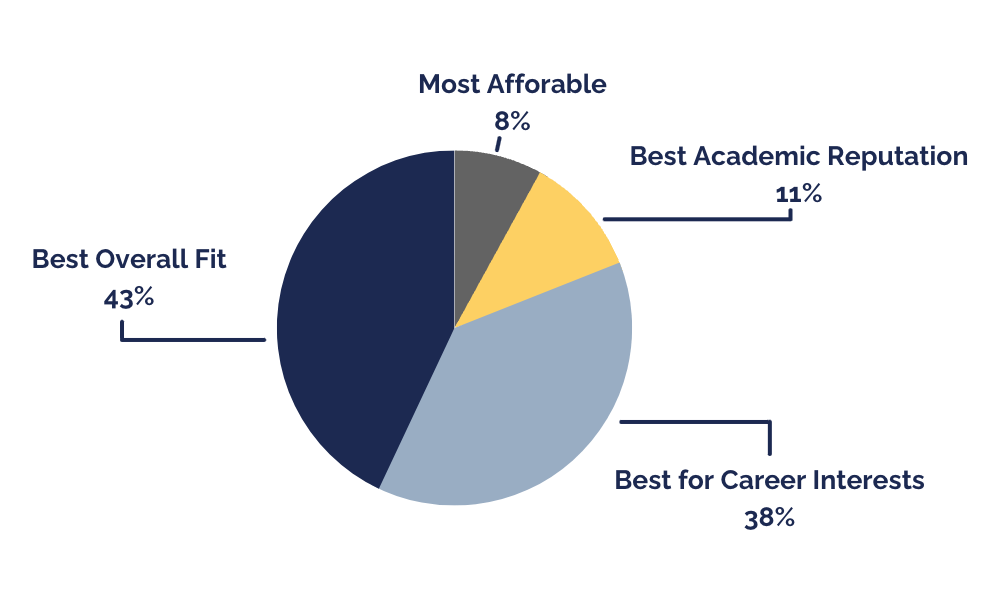

College Priorities

Affordability was cited the least as the top deciding factor for college

Throwing Darts

To be sure, the decision by many schools to no longer require standardized tests has caused application numbers to balloon. This has artificially deflated universities’ acceptance rates by bottom-loading the application pool, experts say.

“These schools every year get better and better at getting students to apply,” said Brian Taylor, managing partner at Ivy Coach, a private college counseling firm. “As an extreme example, more C students applying to Harvard does not make the Harvard applicant pool more competitive.”

New York University received a record-breaking 120,000 applications for the class of 2027, 13% more than last year. Next fall’s freshman year class will be around 5,700 students, bringing their admissions rate down to 8% — a steep drop from 35% a decade ago.

The trend is hard on the many students who don’t get accepted. Addison Witucki found out Thursday that she didn’t get into Harvard or Brown, and is planning to go to the University of Kentucky instead. Her mother, Sarah, said Addison was disappointed but also relieved that she’d have to take on significantly less debt — the school costs $33,150 total for in-state students versus nearly $85,000 for Brown.

“Even that’s still so much money,” Sarah Witucki said. “The fact that a state school costs this much is mind blowing.”

For those who do get in, aid is often an essential part of the equation. Because elite schools with billion-dollar endowments and robust financial resources are able to help students lower the final cost of attendance, it’s sometimes more affordable to attend a private school than a public one, college consultants say. The gap between graduates with federal student loans is relatively small: In 2021, bachelor’s degree recipients from four-year state colleges had an average federal debt level of $21,400, compared to $22,600 for private universities, according to the College Board.

When Preeti Singh’s daughter was applying to college this year, she recalls telling her, “If you’re going out of state then it has to be something really, really good, because I’m not sending you to the neighboring state just for you wanting to be away from home.”

For the Ohio family, who have a second child who will also be applying to college in a couple of years, price was top of mind. Her daughter applied to both state colleges and more selective schools, Singh said.

When she was accepted to Stanford in December, they decided it was worth paying around $65,000 a year for her computer science degree over about $15,000 at Ohio State University. Singh said that after looking at the aid her daughter received, the cost is “manageable” for an elite education.

Originally published on Bloomberg on March 31, 2023